The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

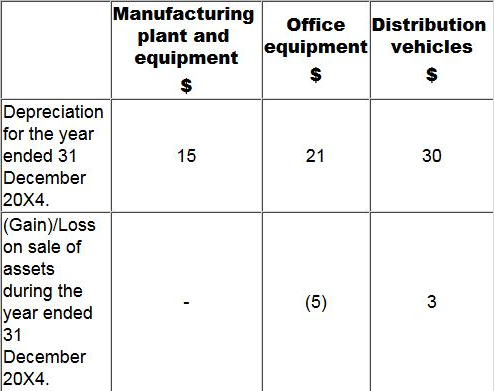

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

What figures should be entered in the Statement of Profit or Loss for the year ended 31 December 20X4 in relation to Administration and Distribution costs?

A. Administration $136 Distribution $120

B. Administration $120 Distribution $87

C. Administration $141 Distribution $117

D. Administration $146 Distribution $114

Answer: A